Why did RBI transfer Rs 76,315 crore to the Contingency Fund? IE expained

The Reserve Bank of India has retained most of its surplus and transferred less to the government.

By George Mathew ,Via https://indianexpress.com/article/explained/why-did-rbi-transfer-rs-76315-crore-to-the-contingency-fund-6570925/

The RBI’s income declined by 29 per cent to Rs 149,672 crore as of June 2020 when compared to Rs 193,036 crore in 2018-19. This is because the previous year’s income included a write-back from Contingency Fund amounting to Rs 52,637 crore which was then transferred to the government.

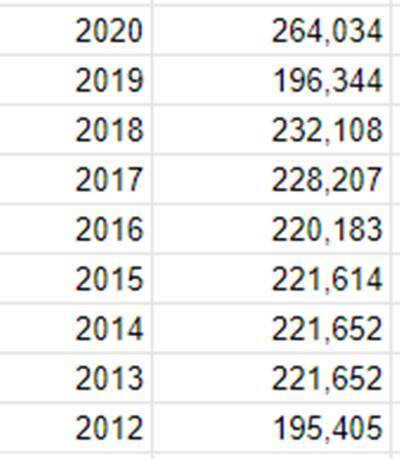

The Reserve Bank of India (RBI), the government’s banker, has retained a whopping amount of Rs 73,615 crore within the RBI by transferring it to the Contingency Fund (CF) of the central bank, thus leading to a sharp fall in the transfer of surplus to the government in the current year. As a result, the CF has swelled to a new high of Rs 264,034 crore, according to the Annual Report of the RBI. The central bank’s main risk provision accounts – Contingency Fund, Currency and Gold Revaluation Account (CGRA), Investment Revaluation Account Foreign Securities (IRA-FS) and Investment Revaluation Account-Rupee Securities (IRA-RS) — together now amount to Rs 13.88 lakh crore.

What is the Contingency Fund (CF)?

This is a specific provision meant for meeting unexpected and unforeseen contingencies, including depreciation in the value of securities, risks arising out of monetary/exchange rate policy operations, systemic risks and any risk arising on account of the special responsibilities enjoined upon the Reserve Bank. This amount is retained within the RBI. With a higher provision of Rs 73,615 crore towards CF, the balance in CF as of June 2020 was Rs 264,034 crore as compared to Rs 196,344 crore in June 2019 and Rs 232,108 crore in June 2018. Last year, it withdrew Rs 52,637 crore from CF to pay a higher surplus to the government.

What did the government get as surplus this year?

The Central Board of the RBI recently approved the transfer of Rs 57,128 crore as surplus – or dividend — to the Central government for the accounting year 2019-20, sharply lower by 67.5 per cent from Rs 1.76 lakh crore that it paid to the government last year. While the RBI’s transfer this year is as per the economic capital framework (ECF) adopted by the RBI board last year, last year’s transfer included Rs 123,414 crore of dividends due from the previous financial year 2018-19 and Rs 52,637 crore taken out from CF as per the revised ECF. As per Section 47 of the RBI Act, profits or surplus of the RBI are to be transferred to the government, after making various contingency provisions, public policy mandate of the RBI, including financial stability considerations.

Why did surplus transfer rise last year?

The government, which was looking for funds to bridge the deficit, sought higher surplus from the RBI pointing out the high reserves/ surplus retained by the RBI. It was initially resisted by the RBI which was then headed by Urjit Patel. The RBI relented later appointed the Bimal Jalan committee to work out the modalities of the transfer. Last year, the RBI said as the central bank’s financial resilience was within the desired range, the excess risk provision amounting to Rs 52,637 crore was written back from Contingency Fund to income, facilitating the transfer of Rs 1.76 lakh crore surplus to the government.

What’s the CGRA account?

The Currency and Gold Revaluation Account (CGRA) is maintained by the Reserve Bank to take care of currency risk, interest rate risk and movement in gold prices. Unrealised gains or losses on valuation of foreign currency assets (FCA) and gold are not taken to the income account but instead accounted for in the CGRA. Net balance in CGRA, therefore, varies with the size of the asset base, its valuation and movement in the exchange rate and price of gold. CGRA provides a buffer against exchange rate/ gold price fluctuations. It can come under pressure if there is an appreciation of the rupee vis-à-vis major currencies or a fall in the price of gold.

When CGRA is not sufficient to fully meet exchange losses, it is replenished from the CF. During 2019-20, the balance in CGRA increased from Rs 664,480 crore as on June 30, 2019 to Rs 977,141 crore as on June 30, 2020 mainly due to depreciation of rupee and the rise in the international price of gold.